“Restaking” has been everywhere this year. Strip the buzzword, and EigenLayer is a clean idea: re-use an ETH/LST stake to secure other services (AVSs) and stack extra yield on the same capital. Efficient, modular… not risk-free. Here’s the clear version.

The problem it solves

On Ethereum, staking secures the base layer—but security stops at L1.

Bridges, oracles, data availability (DA), L2 sequencers, middleware… each one has to reinvent its own security—costly, fragmented, fragile.

EigenLayer’s answer: a market for shared security.

Stakers restake their ETH or LST (stETH, rETH, etc.) inside EigenLayer and “rent out” a chunk of their security to AVSs (Actively Validated Services)—oracles, DA layers, bridges, middleware…

In return, they receive AVS rewards on top of ETH staking rewards.

The core mechanism (no buzzword salad)

Mental flow:

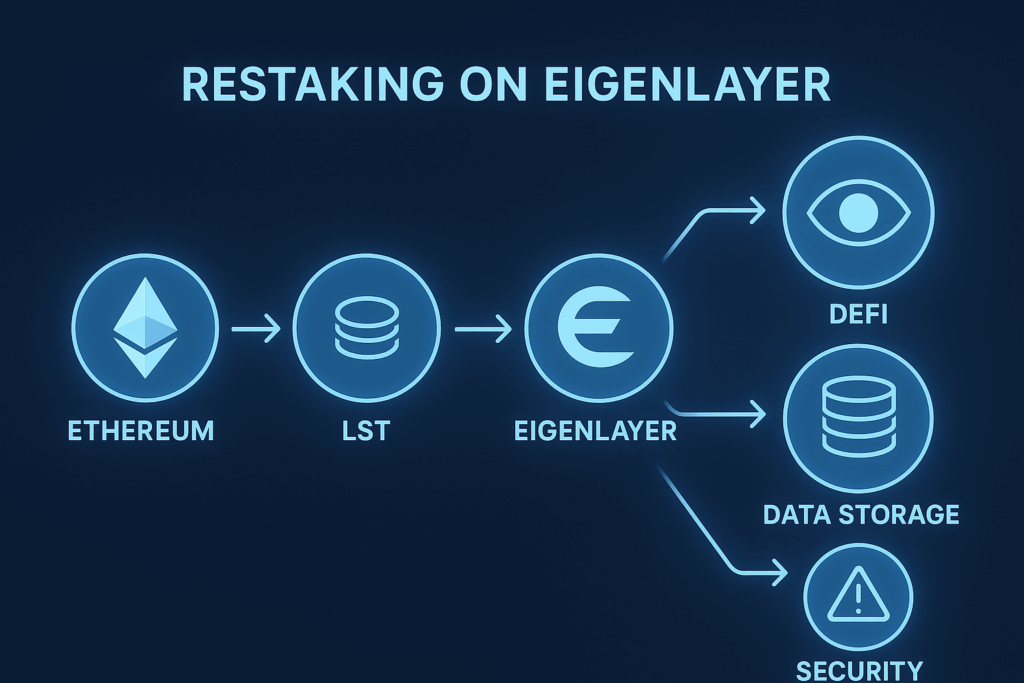

ETH → LST (optional) → EigenLayer (restake) → choose AVS → earn AVS rewards

- You can restake native ETH or a Liquid Staking Token (stETH, rETH…).

- You opt in to one or more AVSs (each with its own slashing rules).

- You earn ETH staking rewards + AVS rewards.

- If you/your operator misbehave, slashing can apply across layers.

Key idea: capital efficiency—one collateral, several security roles.

What AVSs are for (and why it matters)

A few live or emerging AVS use cases:

- Oracles & data middleware: reliable price/state feeds.

- DA layers / modular rollups: data availability off L1.

- Bridges & interop: stronger cross-chain trust.

- L2 sequencers: delegate part of trust to a restaked set.

- Specialized services: attestations, randomness, indexing…

Business translation: instead of 10 small, weak security pools, you buy a slice of one big pooled security (restaked ETH).

LSTs, operators, delegation—who does what?

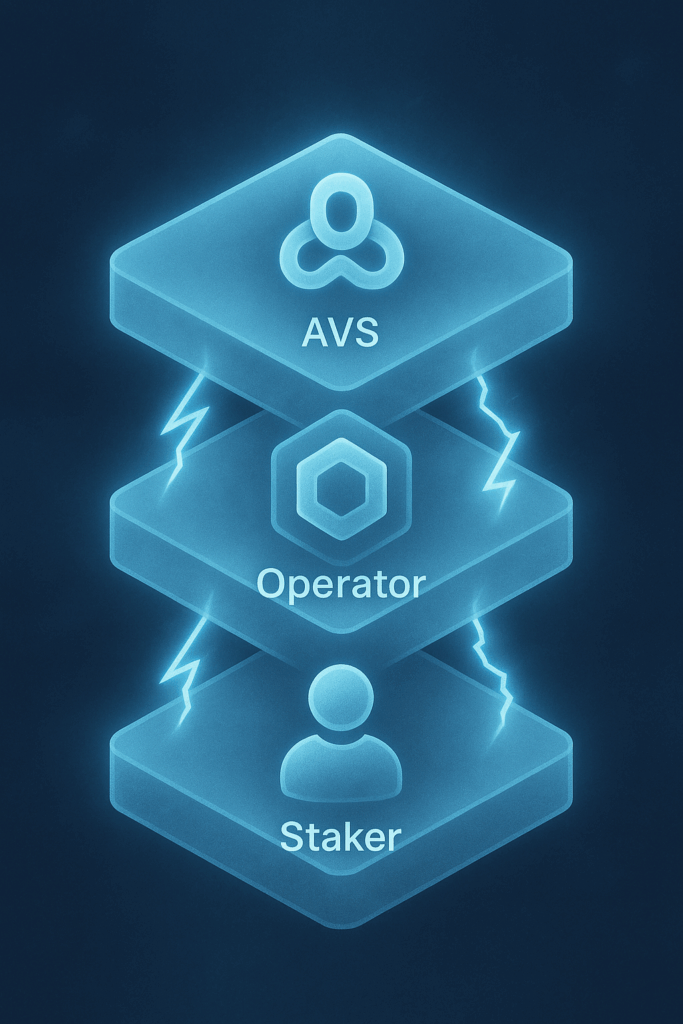

- Stakers: re-use their ETH/LST.

- Operators: run nodes for different AVSs; stakers delegate to them (validator-style).

- AVSs: define slashing rules, rewards, and SLA (what you must guarantee).

Important: always read slashing terms per AVS before opting in.

Why it resonates

- Super-efficient capital: one stake, multiple uses.

- Modularity: compose your security stack as needed.

- Traction: huge LST TVL, rich AVS pipeline.

- ETH composability: tooling, devs, L2s, DeFi are already there.

The risks (and how to look at them)

- Multi-layer slashing: one failure can hit several positions (ETH + AVS).

- Correlation: if an operator runs many AVSs and fails, damage propagates.

- System complexity: risk aggregation (operators, AVSs, markets).

- Governance/dependence: AVS rules, slashing params, upgrades—who decides, how?

Golden rule: diversify operators and AVSs, and understand each AVS’s risk contract.

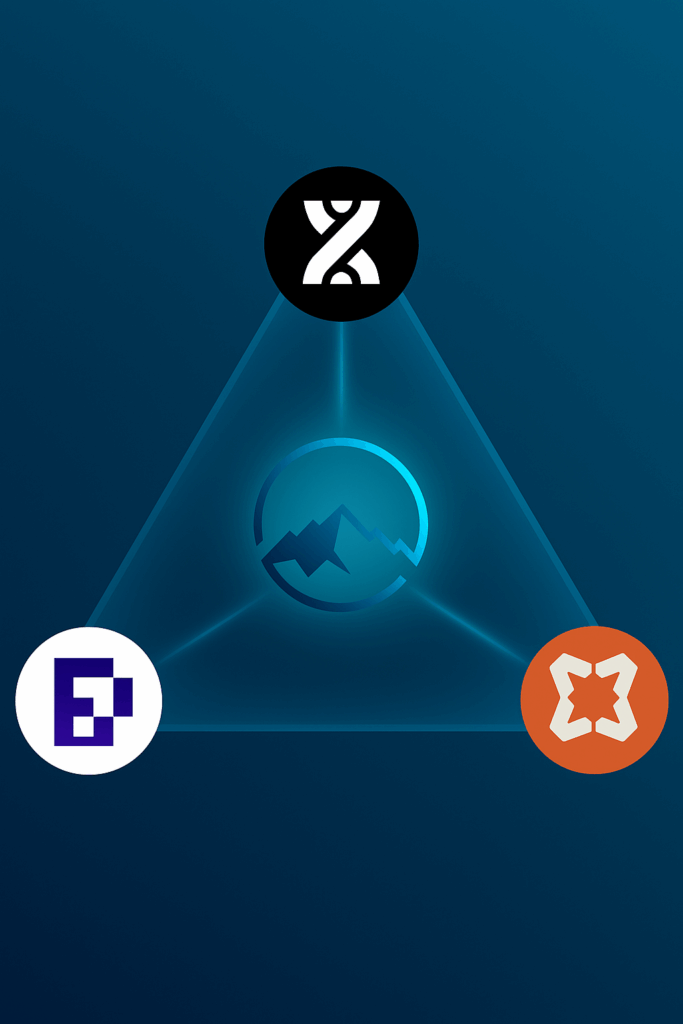

Where EigenLayer sits vs BounceBit & Babylon

- EigenLayer (ETH) shares Ethereum’s security. It’s restaking for the ETH/L2/rollup world.

- Babylon (pure BTC) exports Bitcoin security: BTC stays on Bitcoin, time-locked; finality & slashing get exported to PoS chains (Cosmos first). Max decentralization, more technical UX.

- BounceBit (CeDeFi BTC) monetizes BTC security: regulated custody → BBTC (LCT) → stBBTC (LST) → EVM DeFi, with BTC+BB dual staking. Efficient & liquid, but custody/peg risk.

Mental map: EigenLayer shares (ETH), Babylon exports (BTC), BounceBit monetizes (CeDeFi BTC).

Who should care

- ETH/L2 builders: need “security-as-a-service” for oracles, DA, bridges, sequencers.

- ETH/LST stakers: want to optimize yield (with slashing awareness).

- Crypto treasuries: allocate part of the ETH stack to AVS yield (diversified).

Pragmatic checklist (before you restake)

- Which AVSs? (function, risk model, revenue sources)

- Slashing rules (triggers, timelines, recourse)

- Operator(s) (reliability, track record, monitoring)

- Diversification (avoid concentration)

- Net performance (after fees) + variability over time

Takeaways (3 lines)

- EigenLayer re-uses ETH/LST to secure AVSs and stack yield—the archetype of restaking.

- Pros: capital efficiency, modularity, strong ETH network effects. Cons: multi-layer slashing, correlation, system complexity.

- Compass: vs Babylon (pure BTC that exports finality) and BounceBit (BTC made productive via CeDeFi).