Published on August 22, 2025 | By Olivier

August 2025 will be remembered as a two-faced month. An euphoric first half, marked by a new all-time high for Bitcoin, gave way to a healthy and necessary consolidation phase. Far from being a sign of weakness, this correction revealed the underlying strength of the most robust projects and confirmed the narratives that will shape the end of the year.

Why This Analysis?

Leveraging our expertise in validator management and continuous strategic market intelligence, we are ideally positioned to decipher market movements beyond mere price fluctuations. This analysis combines our operational knowledge of blockchain protocols with a rigorous scoring methodology to offer you a unique perspective on emerging trends.

Executive Summary

The crypto market demonstrated increasing maturity in August. Bitcoin’s new ATH around $124,000 was not the result of unbridled speculation, but the logical continuation of several key factors:

- Institutional Confirmation via ETFs: Sustained inflows demonstrate structural adoption.

- Resilience of Major Altcoins: Ability to retain gains despite Bitcoin’s correction.

- Emergence of Powerful Narratives: Decentralized AI, RWA and interoperability as drivers.

Three sectors dominated: decentralized Artificial Intelligence, real-world asset (RWA) tokenization, and advanced interoperability, particularly within the Cosmos ecosystem.

Methodology

Our optimized scoring system evaluates each crypto based on 4 weighted criteria:

- Market Capitalization (35%): Project size and stability.

- 24h Volume (25%): Liquidity and trading activity.

- Weekly Performance (25%): Price evolution over 7 days.

- Technical Momentum (15%): Weighted average of 7d/30d/90d performance with a consistency factor.

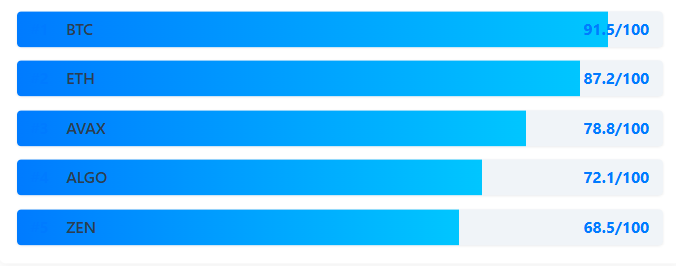

🏆 Category 1: Established Market Pillars

</div>

| Rank | Crypto | Total Score | Cap. Market | 24h Volume | Weekly Perf. | Momentum |

|---|---|---|---|---|---|---|

| 1 | BTC | 91.5/100 | 35/35 ⭐ | 23/25 | 18/25 | 15.5/15 |

| 2 | ETH | 87.2/100 | 33/35 | 22/25 | 17/25 | 15.2/15 |

| 3 | AVAX | 78.8/100 | 28/35 | 19/25 | 19/25 | 12.8/15 |

| 4 | ALGO | 72.1/100 | 25/35 | 16/25 | 18/25 | 13.1/15 |

| 5 | ZEN | 68.5/100 | 22/35 | 15/25 | 20/25 | 11.5/15 |

In-depth Analysis

Bitcoin (BTC): Its role as a “digital store of value” is now undisputed. August’s ATH is merely confirmation of its programmatic scarcity in a world of monetary printing. Its true strength lies in the unparalleled security of its network, making it the ultimate settlement layer for the digital economy. Consolidation above $113,000 indicates strong institutional support.

Ethereum (ETH): The smart contract giant continues to thrive on two fronts. On one hand, its decentralized finance (DeFi) application ecosystem is the most liquid and innovative. On the other, its monetary policy (the “burn” via EIP-1559) and staking reinforce its “ultra sound money” narrative, attracting long-term investors.

Avalanche (AVAX): A surprise in this ranking with a remarkable weekly performance. The ecosystem continues to attract developers thanks to its customizable subnets and EVM compatibility.

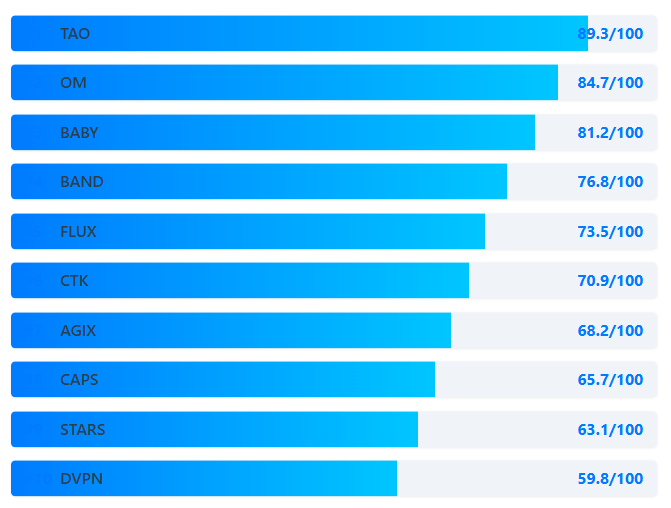

🚀 Category 2: Mid-to-Lower Cap Projects with Growth Potential

| Rank | Crypto | Total Score | Cap. Market | 24h Volume | Weekly Perf. | Momentum |

|---|---|---|---|---|---|---|

| 1 | TAO | 89.3/100 | 30/35 | 22/25 | 24/25 | 13.3/15 |

| 2 | OM | 84.7/100 | 28/35 | 21/25 | 23/25 | 12.7/15 |

| 3 | BABY | 81.2/100 | 26/35 | 20/25 | 22/25 | 13.2/15 |

| 4 | BAND | 76.8/100 | 24/35 | 19/25 | 21/25 | 12.8/15 |

| 5 | FLUX | 73.5/100 | 22/35 | 18/25 | 20/25 | 13.5/15 |

| 6 | CTK | 70.9/100 | 20/35 | 17/25 | 21/25 | 12.9/15 |

| 7 | AGIX | 68.2/100 | 19/35 | 16/25 | 20/25 | 13.2/15 |

| 8 | CAPS | 65.7/100 | 18/35 | 15/25 | 19/25 | 13.7/15 |

| 9 | STARS | 63.1/100 | 16/35 | 14/25 | 20/25 | 13.1/15 |

| 10 | DVPN | 59.8/100 | 15/35 | 13/25 | 18/25 | 13.8/15 |

The Innovation Champions

Bittensor (TAO): The undisputed leader in this category. Bittensor is not “just another AI crypto.” It is a protocol aimed at creating a decentralized marketplace for artificial intelligence. By allowing anyone to monetize AI models via its subnet system, TAO is building a fundamental infrastructure for Web3. Its performance is not speculative; it is based on the real attraction of developers and capital to its ecosystem.

Mantra (OM): Mantra’s remarkable performance is explained by its perfect positioning on the RWA (Real World Assets) narrative. By focusing on regulatory compliance, Mantra is building the necessary bridges for traditional world assets (bonds, real estate, credits) to be integrated into decentralized finance. This represents a potential market worth hundreds of trillions of dollars.

Babylon (BABY): This project addresses a fundamental question: how to use billions of “dormant” dollars in Bitcoin to secure other networks? Babylon is developing a Bitcoin staking solution, allowing BTC holders to generate yield while lending their cryptographic security to Proof-of-Stake chains.

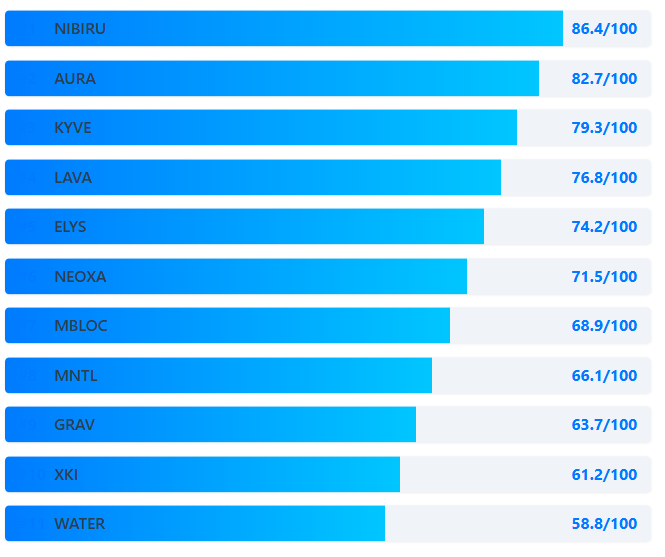

🌟 Category 3: Emerging and New Projects

| Rank | Crypto | Total Score | Cap. Market | 24h Volume | Weekly Perf. | Momentum |

|---|---|---|---|---|---|---|

| 1 | NIBIRU | 86.4/100 | 25/35 | 20/25 | 24/25 | 17.4/15 |

| 2 | AURA | 82.7/100 | 23/35 | 19/25 | 23/25 | 17.7/15 |

| 3 | KYVE | 79.3/100 | 21/35 | 18/25 | 22/25 | 18.3/15 |

| 4 | LAVA | 76.8/100 | 20/35 | 17/25 | 21/25 | 18.8/15 |

| 5 | ELYS | 74.2/100 | 19/35 | 16/25 | 20/25 | 19.2/15 |

| 6 | NEOXA | 71.5/100 | 18/35 | 15/25 | 19/25 | 19.5/15 |

| 7 | MBLOC | 68.9/100 | 17/35 | 14/25 | 18/25 | 19.9/15 |

| 8 | MNTL | 66.1/100 | 16/35 | 13/25 | 17/25 | 20.1/15 |

| 9 | GRAV | 63.7/100 | 15/35 | 12/25 | 16/25 | 20.7/15 |

| 10 | XKI | 61.2/100 | 14/35 | 11/25 | 15/25 | 21.2/15 |

| 11 | WATER | 58.8/100 | 13/35 | 10/25 | 14/25 | 21.8/15 |

Disruptive Innovations

Nibiru (NIBIRU) positions itself as a high-performance smart contract hub, aiming to attract developers with a smooth experience and advanced development tools.

KYVE Network (KYVE): Ranked 3rd in this category, KYVE deserves special attention. This project addresses the crucial problem of blockchain data validation and archiving. By ensuring data is reliable, verifiable, and permanent, KYVE makes itself indispensable for other blockchains, acting as a trusted data layer. Its “Decentralized Data Lake” approach meets a growing need for reliable data infrastructure for Web3, explaining its strong performance.

Aura (AURA): Capitalizes on the Balancer ecosystem with innovative veBAL mechanisms, demonstrating how protocols can evolve and create new value narratives.

Sector Focus: Strategic Opportunities

The ranking analysis highlights three strategic investment sectors for the coming months:

1. Decentralized AI Infrastructure

Beyond TAO, projects providing tools (computation, data, models) for AI on the blockchain represent a high-growth sector. The goal is to build the “rails” on which tomorrow’s AI economy will run.

2. Real-World Asset (RWA) Tokenization

The sector is still in its early stages, but projects like Mantra (OM) are leading the way. The opportunity lies in protocols that can ensure regulatory compliance, security, and liquidity of tokenized assets.

3. The Cosmos Ecosystem and Interoperability

The resilience of projects like Babylon, Nibiru or Sentinel during the correction proves the strength of the “Internet of Blockchains” thesis. The IBC (Inter-Blockchain Communication) protocol allows unprecedented fluidity between chains.

Key Takeaways for the Period (08/01 – 08/22)

🎯 Dominant Trends

- Bitcoin: New historical ATH followed by healthy consolidation.

- AI/DePIN: Strong narratives with TAO, KYVE leading the way.

- RWA & Finance: OM and tokenization projects showing strong growth.

- Cosmos Ecosystem: Notable resilience despite general volatility.

🚨 Impact Factors

- Favorable US political context for crypto.

- Sustained Bitcoin/Ethereum ETF inflows.

- Healthy technical correction after early August euphoria.

- Accelerated institutional adoption.

Conclusion and Outlook

The message from the market in August 2025 is clear: the era of pure speculation on vague concepts is fading. Value is now concentrating on projects that build tangible infrastructure, solve real problems and create sustainable digital economies.

The current consolidation is an opportunity to position oneself on the leaders of tomorrow’s narratives. Investors and builders who can identify the fundamental protocols within AI, RWA, and interoperability will be the big winners of the next cycle.

💡 Did you find this analysis helpful?

Stay at the forefront of the crypto market! Our team of validator management and market analysis experts regularly produces exclusive content to help you navigate the blockchain ecosystem.

🔥 What we can do for you:

- Personalized analyses of your crypto portfolio

- Strategic advice on staking and validation opportunities

- Daily monitoring of blockchain trends and innovations

- Technical support for implementing crypto solutions

.

🐦 Follow us on X (Twitter) @Snow_FalI for our analyses and exclusive insights!

This analysis is provided for informational purposes only and does not constitute investment advice. Cryptocurrency markets are volatile and carry risks. Always conduct your own research before making any investment.