What if your Bitcoin could finally work?

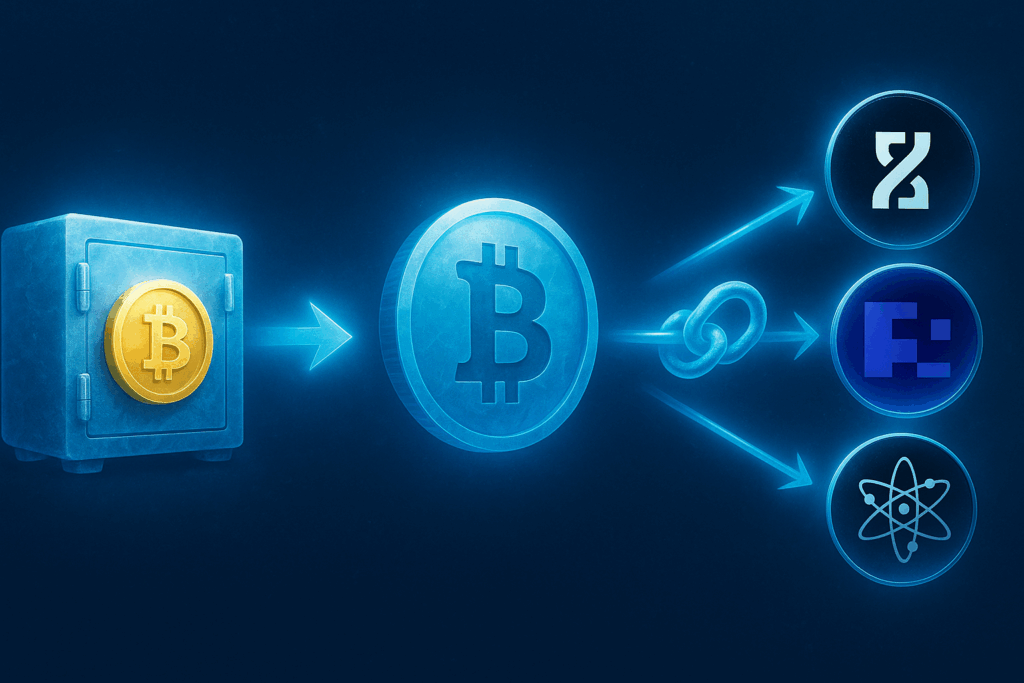

For more than ten years, Bitcoin has been a digital safe: secure, but passive.

Today, a new generation of protocols wants to change that.

It doesn’t aim to replace Bitcoin, but to make it productive.

Welcome to the era of CeDeFi — Centralized-Decentralized Finance — and Restaking, where security and yield finally come together.

🧭 From DeFi to CeDeFi: a bridge between two worlds

🔹 CeFi: the finance of trust

It offers comfort and compliance, but requires trusting intermediaries.

Banks, exchanges, custodial platforms — everything relies on trust.

🔹 DeFi: the finance of code

It removes intermediaries: smart contracts, on-chain transparency, total freedom.

But it remains complex and often intimidating for newcomers.

🔹 CeDeFi: the missing link

CeDeFi combines the regulatory safety of CeFi with the transparency of DeFi.

Funds can be held by regulated custodians,

yet tokenized and used freely on-chain.

🧠 CeDeFi isn’t a betrayal of decentralization —

it’s its adaptation to the real world.

🔧 The new toolkit: LCT, LST and Restaking

🪙 LCT (Liquid Custody Tokens)

An LCT represents an asset held by a licensed custodian.

Example: deposit BTC with a custodian → receive BBTC (1:1).

🔁 LST (Liquid Staking Tokens)

After staking an asset, you receive a liquid token (e.g., stETH or stBBTC)

that accrues yield and remains usable as collateral.

♻️ Restaking

A concept born on Ethereum with EigenLayer:

re-use an already staked asset to secure additional protocols

and earn multiple yield streams on the same capital.

🧠 LCT, LST and Restaking are the new grammar of CeDeFi.

🔺 The Restaking triangle: three visions, one goal

| Criterion | EigenLayer | Babylon | BounceBit |

|---|---|---|---|

| Base | Ethereum | Bitcoin (Cosmos SDK) | Bitcoin + EVM L1 |

| Principle | Restake ETH LSTs | Bitcoin secures PoS chains | Tokenized Bitcoin via custody |

| Yield | On-chain, AVS rewards | PoS rewards (Cosmos) | Hybrid CeFi + DeFi |

| Decentralization | Very high | Full | Partial |

| Audience | DeFi developers | PoS validators | Institutions & DeFi users |

| Narrative | “Restake your ETH” | “Secure PoS with BTC” | “Make Bitcoin productive” |

🧠 EigenLayer shares security.

Babylon exports security.

BounceBit monetizes security.

⚙️ Focus: BounceBit, when CeDeFi meets Bitcoin

BounceBit is the first blockchain to apply CeDeFi to Bitcoin.

Its model: a dual-token Layer 1 where staking combines BTC + BB.

- BTC is held by regulated custodians (e.g., Mainnet Digital, Ceffu).

- It is tokenized into BBTC, then staked to generate yield.

- Validators use both tokens (BTC + BB) to secure the network.

- The ecosystem is EVM-compatible, open to dApps and DeFi tooling.

- Its original brick: BounceClub, a platform to create

your own pools, strategies and bespoke CeDeFi products.

Deposit 1 BTC → receive 1 BBTC → restake it → earn hybrid CeDeFi rewards visible on-chain.

⚖️ Revolution or trade-off?

✅ What it brings

- Yield without selling your BTC

- Institutional-grade custody and compliance

- On-chain transparency of flows

- Continuous liquidity thanks to liquid tokens

⚠️ What it implies

- Custody risk: reliance on centralized custodians

- Complexity: CeDeFi is young and not battle-tested everywhere

- 1:1 peg to monitor (BBTC ↔ BTC)

- Legal framework evolving (MiCA, DAC8, EU rules)

🧠 CeDeFi seeks the balance between yield, compliance and sovereignty.

🧊 Snow-Fall.io: architect of bridges between ecosystems

At Snow-Fall.io, we already host validators and infrastructure

across Cosmos, Babylon, Algorand, Flux, TAO and more.

Our mission: provide non-custodial, bare-metal, transparent services.

CeDeFi opens a new terrain:

where technical expertise meets compliance.

Tomorrow, Snow-Fall could:

- Host hybrid CeDeFi nodes;

- Launch a “Productive BTC” pool for clients;

- Create a Snow-Fall BounceClub for the community.

We observe, analyze and prepare this future — with the same independence ethos.

🚀 Three paths, one summit

EigenLayer, Babylon and BounceBit pursue the same dream:

making blockchain security productive.

CeDeFi may be the first real bridge

where institutional finance and Web3 finally meet.

And perhaps Snow-Fall.io will be that infrastructure bridge between worlds?